The end of world poverty as we know it. Or not yet?

Faithful readers from The Road know of our blog's social project we started back in November. We fund microfinance projects via Kiva, an online non-for-profit "brokerage" service between those in need of a micro finance loan and those willing to fund them.

Over the past months, readers from The Road, friends, friends of friends, and colleagues jumped in, and joined our Kiva lenders' team. At this moment, we total over $6,400 of loans (Check here for the latest status)

The system seems to work well, and after the initial investment in loans, the repayments started to come in two months after the first loan. At this moment, about US$2,000 of loans have been repaid.

It seems Kiva's success caught on real fast. This week alone, they allocated US$1.8 million of microfinance loans. Quite impressive, if you consider that a typical loan is given in chunks of $25.

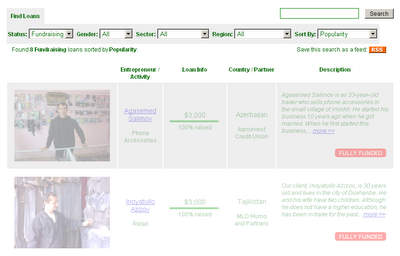

Kiva's success is that big that often, like tonight, you log onto their site, and... they have ran out of people to allocate loans to.

A bit frustrating, knowing that at this moment I am 'sitting' on $600 of repaid loans I would like to reinvest, but on the other hand, their success and apparent efforts to keep up with the success of microfinancing, and particularly success of the brokerage-system of Kiva, shows a difference can be made.

As I am, right now, looking at the screen of the lenders page, searching for people to allocate loans to, I only see grey'd-out fields of entrepreneurs with the remark 'Fully Funded', I am thinking of the song of John Lennon. And "imagine" that maybe that will be, one day, the status of poverty in the world. "We are sorry, but we no longer have people in need".

Call me a dreamer.

Peter. Flemish, European, aid worker, expeditioner, sailor, traveller, husband, father, friend, nutcase. Not necessarily in that order.

Peter. Flemish, European, aid worker, expeditioner, sailor, traveller, husband, father, friend, nutcase. Not necessarily in that order.

3 comments:

This shows that Kiva's bottle neck is in their partner MFIs in developing countries, and their ability to find and screen people to loan to. I believe that onesolution may be to screen less of the loan applicants, provide more information on them (including perhaps social networking data to their peers would could potentially "secure" their loans) and then let the screening be done by the people loaning money.

Just a thought...

@Michael -

Yep, it is correct... I am sure the entrepreneurs are uploaded as fast as the partner MFIs screen people...

I think, though, that one of the successes of Kiva has been the screening process and the low rate of defaulting loans. It gives lenders a certain level of 'sense of security'..

I think finding more partner MFIs would be the solution.

Whatever way, as long as they don't compromise on the quality they have now...

P.

I would actually prefer a different model, where there was a chance of the borrower defaulting, and that it was up to me as a lender to choose a borrower who had a sound business plan.

In reality, the "choose who you loan to" feature on Kiva is a bit of a gimmick, because everyone who makes it on to Kiva will get their loan. If you don't give a loan to a borrower, then someone else will.

Borrowers who already had successfully paid back loans, or who were screened by MFIs would be more likely to get money, but I would like to see something like Kiva which allowed ANYONE to upload their profile and loan request, with photos video even, their story in detail, and links to other borrowers they know who will secure there loan (to provide more security against defaulting). Loans could even be distributed as mobile phone credit (which is used as a form of banking in some parts of Africa). Initially the loans might be small, and the chances of defaulting might be high, but if some people payed back their loans, then vouched for other borrowers, the networks of trust could grow...

Now maybe I'm a dreamer

Post a Comment